How to design a relational model for double-entry accounting with job costing

I would like to commend to readers the answers here and here for the depth and thought that went into them. I stumbled across them while searching for something tangential for a project I'm working on, and I got caught up reading them from top to bottom.

I am trying to build a niche-market app using these principles (namely, double-entry accounting), with job-costing thrown in. The above answers have been extremely helpful in reshaping my concept of what both the accounting and the database-ing should look and work like. However, I'm having a hard time integrating the job-costing portion of the equation into the excellent graphical examples that were provided.

There were several transaction examples using the House, account holders, fees, etc. I have a few other specific use-cases I would love to get some input on:

I have no customers. I buy a property (usually cash goes out, a liability (loan) is created, an asset (the property) is created), spend a bunch of money to fix it up (either cash out at a store, credit card charges at a store, or a check written to a vendor, which debits the property asset and debits or credits the funding source), and then sell it (cash comes in, the loan is paid off, and hopefully there's more cash left than what I spent on the project). This likely creates more ledger entries than I've listed above, but I'm not an accountant. I think I understand that all my costs go toward my basis in the property, and if my net proceeds are greater than my basis, then I've made money, and if not, then not.

So what I need to record are expenses that a) come from a specific account (i.e. company checking account or owner's Best Buy card etc.), b) are generally associated with a specific job (but not always - I do have the occasional overhead expense like office supplies), and c) are always associated with a cost code (i.e. '100.12 - Window Materials', '100.13 - Window Labor', etc.).

Frequently I receive bills from vendors that are due sometime in the future. I would like to track the bills received but not-yet-paid for a given job (committed costs). I think this transaction looks like this, but I'm not really sure:

As you may have surmised from my quip above about the "owner's Best Buy card," I sometimes (more often than I should) use my personal funds for company- and job-related expenses. I think (again with the caveat that I'm a layman) that all of those expenditures credit "Owner's Equity," and debit/credit other accounts as needed.

I've been keeping track of all of this in a big, ugly spreadsheet, which is why I'm trying to build an app to replace it - the spreadsheet method doesn't work very well and it certainly won't scale.

Preliminary

For those reading this Answer, please note that the context is as follows, in increments:

If you have not availed yourself to that, this Answer may not make sense.

I will respond in a sequence that is Normalised, which is of course different to the way you have laid out the problem.

Principle & Correction

There are a few, more than one, errors in your stated problem which you are not aware of, so the first step is awareness; understanding. Once a problem is correctly and precisely declared, it is easy to solve. These are errors that developers commonly make, so they need to be understood as such ... long before an app is contemplated.

1 First Principle

I've been keeping track of all of this in a big, ugly spreadsheet [the spreadsheet method doesn't work very well and it certainly won't scale], which is why I'm trying to build an app to replace it

If the manual (or the previous computerised) system is broken, and you implement a new or replacement app that is based on it, you are guaranteed to carry that broken-ness into the app.

- Worse, if this is not understood, a third app can be written, promising to fix the problems in the second app, but it too, is guaranteed to migrate the problems that were not fixed in the first and second app.

Therefore, you must identify and correct every single problem in the system that you are replacing, including testing, before you can design an app and database that has any chance of success.

Scaling is the least of our worries. How any particular thing works with any other thing is the problem.

The fact that you have one great big ugly spreadsheet means that you have an overall perspective: humans can do that, we can fly by the seat of our pants, but computers cannot, they require explicit instructions.

2 Second Principle

I've been keeping track of all of this in a big, ugly spreadsheet [...] - the spreadsheet method doesn't work very well

Why does it not work [as it stands] ?

Reason 1 of 2.

You make a mistake that developers commonly make: you inspect and study the the bits and pieces of a thing, which is in the physical realm, and try to figure out how the thing works. Guaranteed failure, because how a thing works; its purpose; etc, is in the intellectual realm, not the physical.- I won't detail it here, but the larger problem must be noted. This error is a specific instance of a larger error, and very common, that:

developers focus on the functions of the GUI,

instead of the demand, which is to

correctly define the data and its relations, upon which the functions of the GUI are existentially dependent.

- I won't detail it here, but the larger problem must be noted. This error is a specific instance of a larger error, and very common, that:

A person who has not learned about internal combustion, cannot figure out how to build an engine from looking at the parts of an engine that has been taken apart, even if the parts are laid out carefully. Let alone one with injectors or turbo-chargers. The principle of internal combustion is logical, the parts are physical.

Here you have looked at the spreadsheets that others have used to do their Accounting, and perhaps copied that, without understanding what they are doing with the spreadsheets.

Case in point.

You have examined the first and second linked Answers, and you think you can figure out how to apply that to a new app that fixes the dirty big spreadsheet problem.Many developers think that if they work out the nuts and bolts, copy-paste-and-substitute, somehow the app will work. Note the carefully thought-out, but still incomplete, graphics that details perceived transactions.

They are missing the logical realm, and messing with the physical realm without the demanded understanding of what they are messing with.

In a word, forget about the pretty graphics for the Transactions, both yours and mine, and seek to understand the Logic (this principle) and the Accounting Standard [3].

"Test driven development" aka "code the minimum" aka "trial and error" is a totally bankrupt method, it has no scientific basis (marketing, yes, but science, no), and it is guaranteed to fail. Dangerous, because the cost is ongoing, never finite.

And to keep failing, if you understand the above.

More precisely, it is anti-science, in that it contradicts the science for building apps and databases.

So the first step is to break that great big spreadsheet down into logical units that have a purpose. And certainly, link each referencing spreadsheet column to the right columns in the referenced spreadsheet ... such that any Amount value is never duplicated.

3 Third Principle

I've been keeping track of all of this in a big, ugly spreadsheet [...] - the spreadsheet method doesn't work very well

Why does it not work, either as it stands, or when the spreadsheet has been divided into logical units ?

Reason 2 of 2.

Lack of Standards.

Since the subject matter is Accounting, we must use Accounting Standards.That single great big ugly spreadsheet is ready evidence that you have not used an Accountant to set it up. And of course, you cannot set up a set of spreadsheets to do your Accounting without either understanding Accounting or using a qualified Accountant.

Therefore the second step is to either get an Accountant, or obtain a good understanding of Accounting. Note again, the ready evidence of your carefully thought out transactions: despite the fact that you are a very capable person, you cannot figure out the Accounting logic that is in the first and second linked Answers, let alone the Accounting that you need for your app (or your manual system).

So the best advice I can give you is, as stated in the Double-Entry Accounting Answer, find some good Tutorials on the web, and study them.

If you did that, or hired an Accountant to set up your books, you would split the single big fat spreadsheet into standard Accounting Spreadsheets:

- Balance Sheet:

- Asset or Liability

- Profit & Loss:

- Revenue or Expense

- and one more set (later)

- Balance Sheet:

Another way of stating this principle is this. When one is ignorant that a Standard exists, or worse, when one knowingly chooses to not comply with it, one is left in the dangerous position of re-inventing the wheel, from scratch. Aka "Test driven development", aka "code the minimum possible", aka "trial and error". That means that one will go through an entire series of increments of development, which can be eliminated by observance of the Standard.

Problem & Solution

Now that we understand the principles, we can move on to determination of the specific problems, and their solutions. Each of these is a specific application of the Third Principle.

4 Property/Mortgage Treatment

I have no customers. I buy a property (usually cash goes out, a liability (loan) is created, an asset (the property) is created), spend a bunch of money to fix it up (either cash out at a store, credit card charges at a store, or a check written to a vendor, which debits the property asset and debits or credits the funding source), and then sell it

I am not saying that you have not heeded the advice I have given in the Double-Entry Answer. I am saying you have not appreciated the gravity of the advice; what it means in an Accounting context (before we venture into the database context).

Money represents value. Money; value, cannot be created or destroyed. It can only be moved. From one bucket to another. The demand is to have your buckets defined and arranged properly, according to [3].

The property is not created, it already exists. When you buy a property, there is a movement of your cash to the bank, and a movement of their property to you. In the naïve sense only, the property is now an "asset", the mortgage is now a "liability". That naïveté will be clarified into proper accounting buckets later.

You are, in fact, operating as a small single-branch bank; a cooperative; a casino. The precise context for the Double-Entry Accounting Answer. The following is true for

either a corrected set of spreadsheets,

or for following and implementing the Double-Entry Accounting Answer (if you go directly into the app ... without testing the correction to your single spreadsheet).This is really important to understand, because it has to do with legislation in your country, which you have not mentioned. That legislation will be known to you as Taxation, or your Tax Return for the business. Even if you hold just one property at any one time.

Your "customer" is each bank that is engaged for each property. Name it for the property.

Each mortgage (property) should be set up as an External Account. That will allow you to conduct only those transactions that are actually related to it, against it. Loan Payments; Bank Charges; Expenses; etc. There will be no incoming money, until the property is sold.

In any case, the External Account will match the Bank Statement that the bank gives you for the mortgage account (which you did not mention, but which is a fundamental requirement of Accounting).

As defined in the Double-Entry Accounting Answer, every transaction on an ExternalAccount will have one Double-Entry leg in the Ledger. More, later.

Whether it is an Asset or a Liability in Accounting terms, is a function of the Ledger entry, not a function of the External Account. (By all means, we know it represents a property, which by a naïve perspective is an "asset", until it starts losing money, when it by naïve perspective, becomes a "liability".)

Another way of defining this point is, the bank loan represents a contract, upon which money (value) "changes hands" (is moved). The bank which you engaged is the "customer", the External Account. You must keep all income and expense related to the contract, with the contract.

niche-market app ...

I have a few other specific use-cases ...

- No, you don't. There is nothing new under the sun. If you set up your books correctly (multiple linked spreadsheets using Accounting Standards), this is a vanilla use case. Hopefully my explanation has demonstrated that fact.

5 Ledger

Where the above points have to do with the intellectual realm, the understanding of each problem and therein the solution, which causes little work in the physical realm, this point, which has the same demand for the intellectual, is onerous at the physical level. That is, the number of keystrokes; checking; changes; checking ... before you get it set up correctly.

Although the first linked Answer deals with:

Derived vs Stored Account Balance (efficient and audit-able processing re month end),

and the second linked Answer deals with:

Double-Entry Accounting (implementation of an over-arching Accounting Standard in an existing Accounting system, a higher level of audit-ability),

neither explains the Ledger in detail.The Ledger is the central article of any Accounting system.

The Double-Entry system is not a stand-alone article, but an advancement to that Ledger.

The data model is the specific how to set the database up correctly for both the app, and any reporting client s/w to use, uneventfully.

You do not have a true Ledger. The single big spreadsheet is not a Ledger.

You must set up the Ledger, according to [3]. At best, some of the items in that spreadsheet will be entries in the Ledger, but note, you will perceive them quite differently, due to the corrections set forth in [1][2][3].

Note that when we say "put that in the Ledger" or "that is not in the Ledger", which is for simplicity, what we mean precisely is a reference to single Ledger Entry, which is identified by a specific Account Number in the Ledger.

- In the data model, this is

LedgerNo.

- In the data model, this is

Likewise, when we say "Accounts", we mean precisely a single Account Number in the Ledger.

- If a transaction is not in the Ledger (a specific Account Number, a

LedgerNo, one leg of the DEA Credit/Debit), it is not in the "accounts", it is not accounted for.

- If a transaction is not in the Ledger (a specific Account Number, a

This is where you will set up genuine Accounts for Assets, and for Liabilities. This is for Internal purposes, in the Ledger, as declared in the margin for Internal in the data model.

The best advice I can give you is, trawl the web for Tutorials on Accounting; determine which are good; study them carefully, with a view to setting up a proper Ledger for your purposes.

The simple answer is, the Ledger is an Hierarchy of Account Numbers.

Wherein the leaf level is an actual

AccountNothat can be transacted against,

and the non-leaf levels exist for the purpose of aggregation, no transactions allowed.Whenever the Ledger is reported (or any derivative of the Ledger, such as BalanceSheet or Profit & Loss):

the hierarchy is shown by indentation, the transactional Account entries show the Current Balance for the current month

and the aggregate Account entries show the aggregate for the tree under it

[your graphics re transactions]

First and foremost, every Transaction is in the Ledger. That means one leg of the Double-Entry Accounting Transaction is in the Ledger. Look at § 5 in my Double-Entry Accounting Answer, notice that every Business Transaction has at least one blue entry (do not worry about the other details).

Second, the other DEA leg is:

either in the Ledger, meaning that the money moved between one Ledger Account

LedgerNoand another Ledger AccountLedgerNo. Notice the Business Transactions where both sides are blue.or in an External Account, meaning that the money moved between one Ledger Account

LedgerNoand an External AccountAccountNo. Notice the Business Transactions where one side is blue and the other is green.

When you understand that, and you have your Ledger set up, there will be no "??" in your graphics, and the blue/green will be shown. (Do not re-do your graphics, I expect that this Answer will suffice.)

- Your "asset/liab" designation is not correct. More precisely, it is premature to make that declaration before the Ledger is fully defined and arranged. First set up your Ledger, with Asset/Liability for each entry in mind. Then you will not have to declare "asset/liab" on each transaction, because that is a function of the Ledger Account Number

LedgerNo, not a function of the transaction.

- Your "asset/liab" designation is not correct. More precisely, it is premature to make that declaration before the Ledger is fully defined and arranged. First set up your Ledger, with Asset/Liability for each entry in mind. Then you will not have to declare "asset/liab" on each transaction, because that is a function of the Ledger Account Number

expenses that a) come from a specific account (i.e. company checking account or owner's Best Buy card etc.),

Ledger-ExternalAccount

(one DEA leg in the Ledger, the other leg in the External Account). Noting the caveats above. The other DEA leg will be to one of these (hierarchy):

- Expense/Property Improvement/Structure/Material

- Expense/Property Improvement/Structure/Labour

- Expense/Property Improvement/Fitting/Material

- Expense/Property Improvement/Fitting/Labour

- Expense/Property Improvement/Furniture

expenses that c) are always associated with a cost code (i.e. '100.12 - Window Materials', '100.13 - Window Labor', etc.).

You will no longer have "cost codes", they will all be Ledger Account Numbers LedgerNos, because the Ledger is where you account for anything and everything.

One DEA leg in the Ledger, the other leg in the External Account for the particular property. The hierarchy will be the same as the previous point.

expenses that b) are

generallyassociated with a specific job

Ledger-ExternalAccount

(one DEA leg in the Ledger, the other in the External Account).

(but not always - I do have the

occasionaloverhead expense like office supplies)

Ledger-Ledger

one DEA leg in the Ledger for an Expense or Liability

LedgerNo... that the money was paid to- Expense/Regular/Office Supplies

the other leg in the Ledger for a Revenue or Asset

LedgerNo... that the money was paid fromRevenue/Monthly Payable

6 Credit & Other Card Treatment

credit card charge

Best Buy card

Each of your cards represents a contract, an Account that that needs to be transacted against, that must be balanced against the monthly statement provided by the institution that issued the card.

Set up each one as an External Account, one DEA leg here, the other in the Ledger.

"owner's Best Buy card" is not clear to me (who is the owner, you or the property owner ... if the latter then the assumption thus far, that "you" buy and sell properties is incorrect.)

In any case, I believe I have given enough detail for you to figure it out.

Do not amalgamate an owner's property Account and their Best Buy card into one External Account: keep separate External Accounts for each.

7 Job Costing

Notice that I am addressing this last, because once you fix the big problems, the problems that remain, are small. What you set out as the big problems (job costing; profit/loss per property) are, once the Ledger has been set up correctly for your business, actually small problems.

As far as I can see, Job Costing is the only remaining point that I have not addressed. First, the issue to be understood here is, the difference between Actuals and Estimates. Everything I have discussed thus far are Actuals.

For Estimates, the Standard procedure is to set up a separate Account structure (tree in the hierarchy) in the Ledger. These are often called Suspense Accounts, as in money that is held in suspense.

Treated properly, these Accounts will prevent you from closing or finalising an External Account before all the Estimates have been transferred to Actuals (Suspense to zero).

The Business Transactions are exactly the same as for Actuals.

This will provide precise tracking of such figures, and also the difference when an item moves from Estimate to Actual.

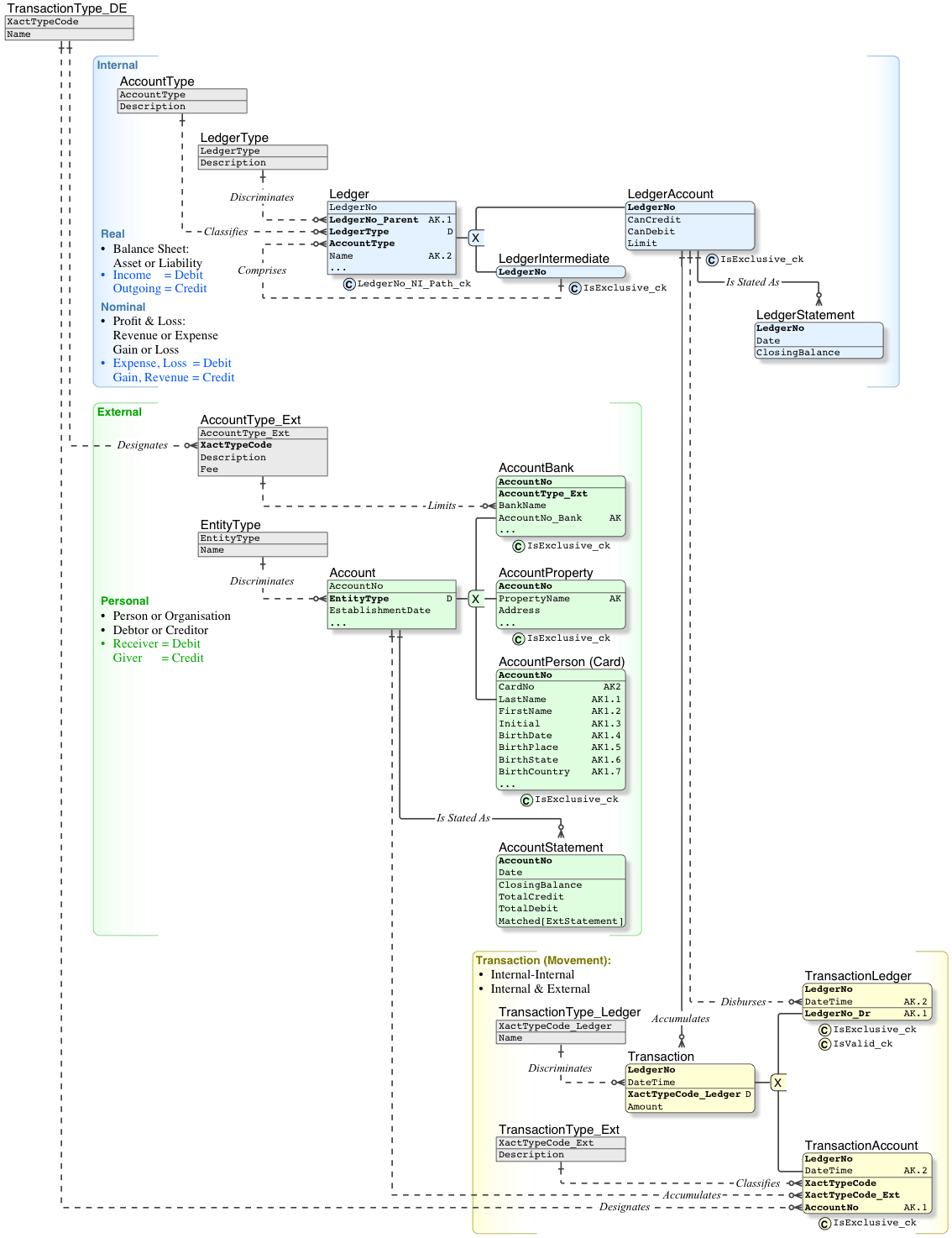

8 Data Model • Job Costing

Noting that the data model in the first and second linked Answers are complete for the purpose, wherein the Ledger is not expanded:

this Answer deals with explanation of the Ledger, and this data model gives the full definition of a

Ledger- Arranged by

AccountType - A single-parent hierarchy

- Only the leaf level

LedgerAccountmay be transacted against - The intermediate level

LedgerIntermediateis for summarising the tree below it.

- Only the leaf level

- Arranged by

I have further Normalised

Transactionexpanded External

Accountto show a Person vs an OrganisationAll constraints are made explicit.

Obviously too large for an inline graphic. Here is a PDF in two pages:

- the Data Model alone (as above)

- the Data Model with sample data and notes, it includes all the examples covered in the Answer

- Note the indentation in the Ledger, which denotes the Account hierarchy

Comments

Javad

How do you insert the first ledger (e.g. 100 Asset, no parent)?

The Ledger is a Tree, a Single Parent Hierarchy (aka "one way" for strange reasons), as per Account Hierarchy.

Refer to the Relational Hierarchy doc for an overview of Relational Hierarchies and a generic definition of each.

A root row is required. In a database build operation (using DDL from a file), we generally do all our CREATE TABLEs, followed by all our ADD CONSTRAINT FKs. Insert the root row in with the CREATE TABLE.

After the

CREATE TABLE Ledger

do

INSERT Ledger VALUES ( 0, 0, "I", "AL", "Root", ... ).After the

CREATE TABLE LedgerIntermediate

do

INSERT LedgerIntermediate VALUES ( 0 ).

Given that the reverse of Comprises is belongs to, all first-level Ledgers eg. Fees, House, Interbank and your Asset would belong to this root row.

bknux

I assume in your transfer example you left out a transfer id because this is an example. Else I don't really get how you track money in a larger context where transaction with the same amount, may occur in the same time.

The data model is Relational, Id fields are prohibited in the Relational Model, the additional field & additional index are simply not necessary here. The LedgerTransaction.PK (and AK) does prevent duplicates (transactions that occur "at the same time", 3 ms precision) regardless of Amount. Money is tracked due to DEA, not merely due to good Keys.

I'm referring to your related DEA Answer, §5 Business Transaction with Row, Example 4, the transfer of 100$ between Mary and John. By the DEA example given, I can track amounts in total, so I know, that the housecash grew 100$ and mary's amount shrank 100$, for the other side vice versa.

But to know, that mary send 100$ to john, requires both AccountXact and the one ledgerXact (or only the two account Xacts) to be matched by time (fuzzy) and amount.

By Tracking I mean having a connection between Mary and John

There is no connection between Mary and John [in the Ledger], so do not try to make one, especially not by time, because DateTime already has specific meaning. It would be a gigantic fudge, adding meaning to a column that means something else.

To track something outside the Ledger, use a tracking device outside the Ledger. Say that Mary walked in with 1 Withdrawal slip and 1 Deposit slip: even if the slips have serial nos, they would not be related, so that is not useful. For tracking several different Ledger Transactions, outside the Ledger, we need to define precisely, what that is, and add the necessary tables.

Larger context: I will assume that such Transactions need to be tracked because they are a single batch, which is what identifies that they are related (not only because the Amount is the same). A single event:

- eg. where Mary fronts up to a teller and submits 1 Withdrawal and 1 Deposit (for John) (

Amountis the same) - eg. a shop owner makes 5 different Deposits, then pays his mortgage account; and his personal account (

Amountsare not the same).

It requires a Data Model that is a bit more advanced (which is why I brought your question over to this answer), and

- a Batch table to identify the batch of related Transactions

- using a bank teller example, the identifier for the event would be

( Teller, DateTime )- where the latter is

SMALLDATETIMEgiving 1 min precise - noting that

Transaction.DateTimeisDATETIMEgiving 3ms precision

- where the latter is

- this model constrains each Ledger Transaction to belong to a discrete Batch (ie. the Batch identifier is not optional)

- The

NettAmountacross the Batch is derived, not stored (italics).

Refer to page 3 in this Data Model PDF.

- Options for eliminating NULLable columns from a DB model (in order to avoid SQL's three-valued logic)?

- What is the difference between Views and Materialized Views in Oracle?

- PostgreSQL Foreign Key syntax

- Same Table value selection from same clients

- Databases with Foreign Keys: Good way to picture forward vs. backward relationship?

- Does "tuples are not necessarily distinct" imply they are equal? How do I show whether this multivalued dependency holds in the example table?

- How to create relationships in MySQL

- What are the scalability limitations of relational databases?

- When to use MongoDB

- How to structure and query an appointment system based on time slots where each bookable entity has a different time table daily?

- One to one relationship in MySQL and cascade delete

- How do databases maintain results if another query edits those results

- How can I update a large table slowly?

- Meaning of hashtag in a relational schema

- In SQL, how to search for rows by binary data prefix?

- Android Room: How to extract data from relational tables?

- Dynamic content types: One table with many columns or one table for each?

- What is the difference between MySQL & MySQL2 considering NodeJS

- Relational Data Model for Double-Entry Accounting

- When should you use a one-to-one relationship with tables in your database?

- get unprocessed rows that have no association in processed table

- Difference between superkey and composite key

- How to get results with distinct values when we use Group by

- Database design for school fee processing

- How to get the mysql database relationship diagram

- How should international geographical addresses be stored in a relational database?

- Reporting AWS Tools RDS or Redshift?

- How can I get partial participation of both entities in 1:1 relationship

- How would you set up a database to handle comments for a blogging site?

- Can't get Laravel associate to work